ESTATE PROTECTION

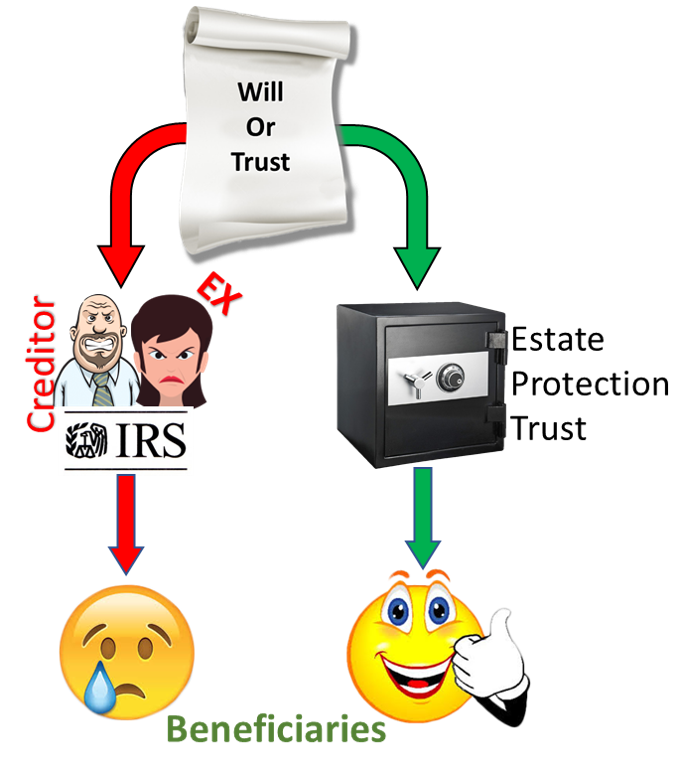

Like most, you probably have a revocable living trust or a will to pass your assets to your children. What you don’t know is sadly those devices do not offer asset protection against our children’s creditors. Unfortunately, we live in the most litigious society in the world. Over 55% of our children will go through divorce settlement alone, not counting bankruptcy, tax liens and business litigation. The causes are endless. You set up your trust or will to pass your assets to your children, not to their creditors. Sadly, your estate ends up TAKEN by their creditors even BEFORE they receive it. It doesn’t have to be this way. A very simple yet very effective asset protection layer can be added to your will or trust. This layer will insulate the assets of your estate and protect them so only your children will have access to it to enjoy it, not their creditor and ex-spouses, just as you intended.